Read our 2020 survey of Africa’s Top 250 companies

There is little doubt that consumption is going to become a more important part of African GDP over the next 20 years. The growing middle classes that are evident in many countries are consuming more in terms of volume and consuming more selectively. Fashion, electronic goods and cars will all play their role but food and beverages absorb most of this new consumer spending.

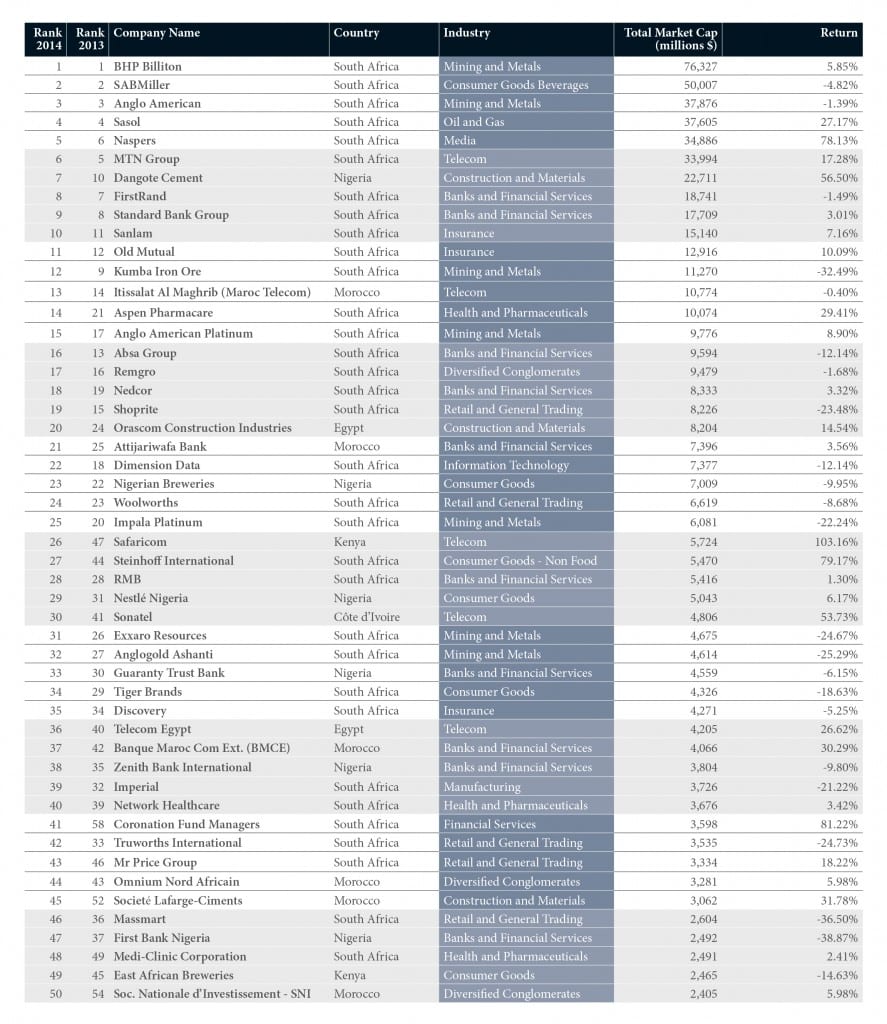

Africa does not yet possess retail chains of the size of Walmart in the US, Tesco in the UK and Carrefour in France but South Africa’s shopping giants are now expanding into the rest of the continent. There are 13 retail companies in our Top 250 and all but Label Vie of Morocco is South African.

Shoprite and Woolworths lead the way in our table, but more rapid expansion into the rest of the continent will necessitate a cultural shift away from shopping in markets and towards supermarkets. This process has begun in some cities but is decades away in many rural areas.

One of the most well-known brands in the South African supermarket sector, Pick n Pay, is banking on cross-border investment to drive its recovery. Chief executive Richard Brasher says: “There is still a great deal of work to be done. We’ve warmed up, we have stretched and trained, we are a bit fitter and sharper and now the hard work can really begin.”

The company has more than a thousand outlets in six Southern African markets and plans to open 100 more over the next 12 months. Its operations outside South Africa are performing more strongly than those in its core market and it is now considering expanding into Nigeria, although other markets are not always straightforward. Last year Pick n Pay opted to pull out of Mozambique.

Brewing success

Out of the 31 companies listed in our table as consumer goods (food and beverages) firms, 13 are predominately brewing companies and several of the others have a least a foot in that camp. Beer is big business in Africa and the continent boasts the second-biggest player in the industry worldwide, in the form of SAB Miller. Although second in our overall table, the company’s fourth quarter income was lower than forecast, promoting a short term fall in its share price.

Active around the world, perhaps the company’s biggest opportunity for growth is on the African continent, as more people secure disposable income and gain a preference for higher quality products. The disappointing quarterly result was blamed on “political tensions in some markets, as well as a 50% excise tax increase in Zambia.” Currency volatility has affected its profits and so the company is seeking to source more of its raw materials locally.

West Africa was the company’s best performing region, with double digit volume growth in both Ghana and Nigeria, but Zimbabwean lager sales volumes fell by 18% because of renewed economic problems in that country.

In the company’s annual report, chief executive Alan Clark, said: “The combination of our global overview and deep local insights enables us to fine tune our operations in each market and to deliver commercial progress which underpins our confidence in our ability to deliver higher revenue growth in the longer term.”

East African Breweries has said that its operations have been affected by the introduction of a sales duty on its Senator Keg beer. The price of the low-cost beer increased by 60% overnight, cutting sales by 85% for the second half of 2013.

Chief Executive Charles Ireland told journalists: “We have got some work to do to mitigate the effects of that. We expect our revenue and profitability to grow marginally.”

The company, which is mainly owned by British drinks giant Diageo, has responded to the new duty by launching a new bottled beer for the lower end of the market. Despite the tax, it recorded a 5% rise in pre-tax profits for the first half of the current financial year, to KSh6.08bn ($71.1m).

With the possible exception of Safaricom, the most impressive change over the past 12 months has been the growth recorded by Tanzania Breweries. This year it ranks fourth in our Eastern Africa regional table with a market capitalisation of $1.1bn, up from 14th last year with just $447m. An offshoot of SABMiller, it enjoys a 70% market share in Tanzania.

Recent Comments